Navigating the world of personal finance can be daunting, especially when it comes to understanding the credit scoring system. This guide will break down the essential elements of credit scores, how they are calculated, and why they matter.

What is a Credit Score?

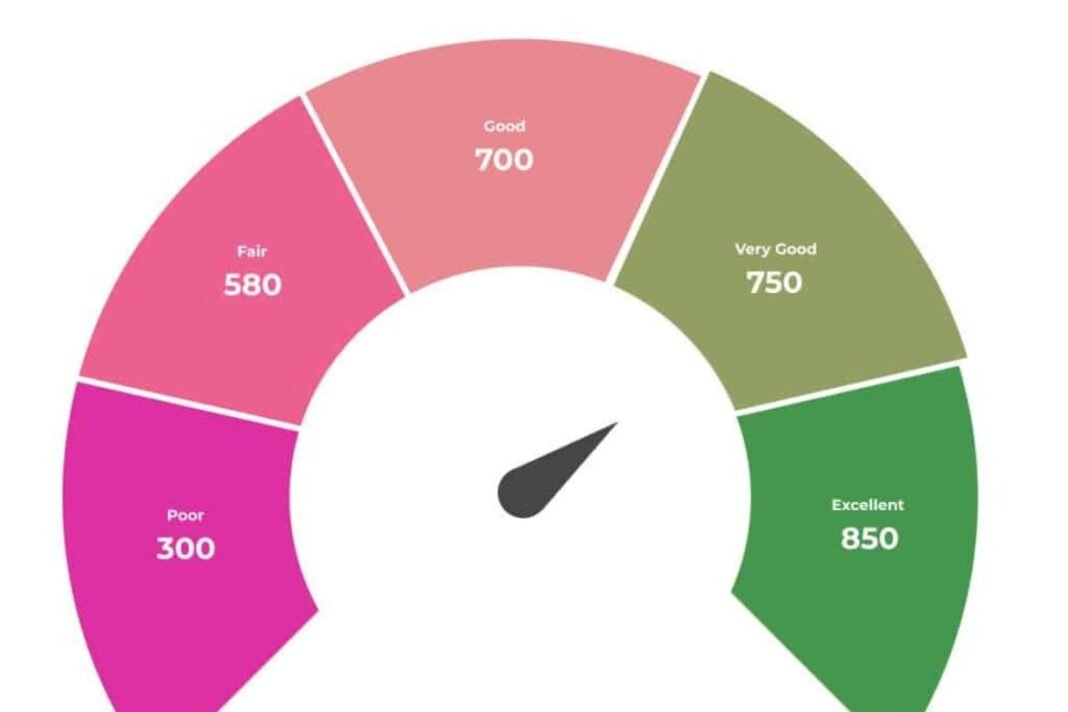

A credit score is a numerical representation of your creditworthiness. It helps lenders evaluate the risk of lending you money or extending credit. Typically, scores range from 300 to 850, with higher scores indicating better creditworthiness.

How is the Credit Scoring System Calculated?

The credit scoring system uses various factors to calculate your score. Here are the key components:

1. Payment History (35%)

Your payment history is the most significant factor in determining your credit score. It reflects whether you’ve made payments on time, late payments, and any defaults or bankruptcies.

2. Credit Utilization (30%)

Credit utilization measures how much of your available credit you’re using. Ideally, you should keep your credit utilization ratio below 30%. High utilization can negatively impact your score.

3. Length of Credit History (15%)

The length of your credit history also plays a role. A longer credit history can positively affect your score, as it provides more data for lenders to assess your credit behavior.

4. Types of Credit Accounts (10%)

A mix of credit types—such as credit cards, mortgages, and installment loans—can boost your score. Lenders prefer to see that you can manage different types of credit responsibly.

5. New Credit Inquiries (10%)

Each time you apply for new credit, a hard inquiry is made on your credit report. While a single inquiry might not have a significant impact, multiple inquiries in a short period can lower your score.

Why is the Credit Scoring System Important?

Understanding the credit scoring system is crucial for several reasons:

1. Loan Approval

Lenders use credit scores to determine your eligibility for loans and credit cards. A higher score can increase your chances of approval.

2. Interest Rates

Your credit score directly affects the interest rates you are offered. Better scores usually lead to lower interest rates, which can save you money over time.

3. Rental Applications

Many landlords check credit scores as part of their tenant screening process. A good score can help you secure a rental property.

4. Insurance Premiums

Some insurance companies use credit scores to determine premiums for auto and home insurance. A better score could mean lower rates.

Tips for Improving Your Credit Score

To navigate the credit scoring system effectively, consider the following tips:

1. Pay Bills on Time

Establish reminders or automate payments to ensure you never miss a due date.

2. Reduce Credit Card Balances

Aim to pay down existing balances and maintain a low credit utilization ratio.

3. Check Your Credit Report Regularly

Monitoring your credit report can help you catch errors or fraudulent activity that could impact your score.

4. Limit New Credit Applications

Only apply for new credit when necessary to minimize hard inquiries.

5. Keep Old Accounts Open

Maintaining older credit accounts can contribute positively to your credit history length.

Conclusion

Understanding the credit scoring system is essential for making informed financial decisions. By knowing how credit scores are calculated and the factors that influence them, you can take proactive steps to improve your creditworthiness. Whether you’re planning to apply for a loan, rent an apartment, or secure insurance, a solid grasp of your credit score can lead to better financial outcomes.