When it comes to trading, having the right tools and indicators can make all the difference in your success. One such indicator is the KDJ Indicator, which is available on kdj 指标 Thinkorswim – a powerful trading platform offered by TD Ameritrade. This article delves into the KDJ Indicator, its function, and how to use it on kdj 指标 Thinkorswim for making informed trading decisions.

What is the KDJ Indicator?

The KDJ Indicator is a technical analysis tool that blends three essential indicators: the Stochastic Oscillator, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). It was designed to provide more accurate buy and sell signals by refining these individual components into a unified metric.

- K stands for the Fast Stochastic line.

- D is the Slow Stochastic line.

- J is a special line that highlights the divergence of the K and D lines, thus indicating potential trend reversals or breakout points.

The KDJ Indicator is often used to detect overbought and oversold conditions in the market, which can signal potential price reversals. It’s commonly applied in stocks, forex, and commodities trading.

How Does the KDJ Indicator Work?

At its core, the KDJ Indicator works by analyzing price momentum and identifying areas where the price is either overextended or ripe for a reversal. Here’s how the three components function:

1. K Line (Fast Stochastic Line)

This line is the most sensitive of the three and reacts quickly to changes in market conditions. It oscillates between 0 and 100, with values above 80 indicating that an asset might be overbought, and values below 20 suggesting it could be oversold.

2. D Line (Slow Stochastic Line)

The D Line is smoother and slower than the K Line, as it is a moving average of the K Line. It helps to filter out noise from market fluctuations and provides a clearer view of the market’s general trend.

3. J Line

The J Line is the unique feature of the KDJ indicator. It is derived from the difference between the K and D Lines, and its movement can indicate potential momentum shifts or price reversals. When the J Line moves above 100 or below 0, it can signal extreme conditions that are typically followed by a market correction.

How to Set Up the kdj 指标 Thinkorswim

kdj 指标 Thinkorswim provides a simple and intuitive way to implement the KDJ Indicator in your charts. To set it up, follow these steps:

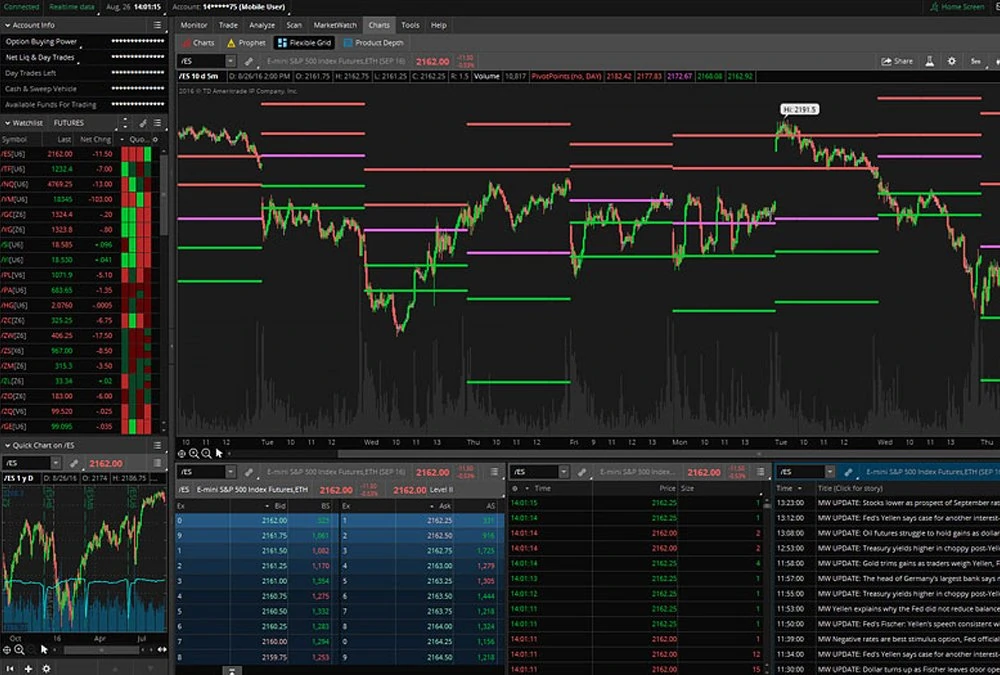

Step 1: Open the kdj 指标 Thinkorswim Platform

If you don’t have the kdj 指标 Thinkorswim platform installed, you’ll need to download and install it from TD Ameritrade’s website. After installation, launch the platform and log into your account.

Step 2: Access the Charts Tab

Once logged in, navigate to the Charts tab, where you can analyze price data for various assets.

Step 3: Add the KDJ Indicator

To add the KDJ Indicator to your chart, follow these steps:

- Click on the Studies button at the top of the chart window.

- Select Edit Studies.

- In the Edit Studies and Strategies window, type “KDJ” in the search bar.

- If the KDJ Indicator is available, it will appear in the list of studies. Select it and click Add Selected.

- Click OK to apply the indicator to your chart.

Step 4: Customize the KDJ Settings (Optional)

kdj 指标 Thinkorswim allows you to adjust the parameters for the KDJ Indicator. You can fine-tune the settings according to your trading preferences or the asset you’re analyzing. The default settings are typically set to 14-period for the K and D lines, but you can change this based on your

trading strategy or time horizon.

To customize the settings:

- In the Edit Studies window, select the KDJ study.

- Click on the gear icon next to the study name to open the settings window.

- Adjust the K Period, D Period, and J Period based on your preferences. Typically, a 14-period setting is used for these indicators, but shorter or longer periods can be tested for different timeframes.

- Click OK to save your changes and apply them to the chart.

Key Advantages of Using the KDJ Indicator

The KDJ Indicator offers several benefits for traders, especially those who want a more comprehensive view of market momentum. Here are some of the key advantages of using kdj 指标 Thinkorswim:

1. Clear Buy and Sell Signals

The KDJ Indicator provides more actionable buy and sell signals compared to its individual components. Traders typically look for crossovers between the K and D lines, as well as extreme readings in the J line, to identify potential trend reversals.

- Bullish Signals: When the K line crosses above the D line, and the J line moves above 0, it may signal that an asset is likely to continue its upward momentum.

- Bearish Signals: When the K line crosses below the D line, and the J line dips below 100, it may indicate that a downtrend is imminent.

2. Helps Detect Overbought and Oversold Conditions

The KDJ Indicator excels at identifying when an asset is either overbought or oversold, which often precedes a price correction. For example, when the KDJ values are extremely high (over 100) or low (below 0), traders may consider entering a trade to capitalize on potential price reversals.

3. Combines Multiple Indicators into One

By combining the Stochastic Oscillator, RSI, and MACD, the KDJ Indicator provides a more nuanced view of market momentum. This integration can help traders make better-informed decisions by offering more confluence between different signals, reducing the likelihood of false signals.

4. Customizable to Fit Different Trading Styles

kdj 指标 Thinkorswim’s customization options allow traders to tweak the KDJ settings to suit their specific trading strategies. Whether you’re a short-term day trader or a long-term investor, the KDJ Indicator can be adapted to different timeframes and asset types.

How to Interpret kdj 指标 Thinkorswim

The kdj 指标 Thinkorswim provides valuable insights into market momentum, but understanding how to read its signals is crucial for making informed decisions. Here’s a breakdown of how to interpret the KDJ signals:

1. K Line and D Line Crossovers

A bullish crossover occurs when the K line crosses above the D line, indicating potential upward momentum. Conversely, a bearish crossover happens when the K line crosses below the D line, suggesting the possibility of a downward trend.

- Bullish Signal: K crosses above D

- Bearish Signal: K crosses below D

These crossovers are the most basic signals, and many traders use them in combination with other indicators or chart patterns to confirm their trade entries.

2. J Line Overbought and Oversold Zones

The J line is particularly useful for detecting extreme conditions in the market. If the J line moves above 100, it suggests that the asset is potentially overbought, signaling a possible correction or reversal. Similarly, if the J line moves below 0, the asset could be oversold and may experience a bounce back.

- Overbought Condition: J Line > 100

- Oversold Condition: J Line < 0

3. Divergence

Divergence occurs when the price of an asset moves in the opposite direction of the KDJ 指标 Thinkorswim lines. For example, if the price is making new highs, but the KDJ 指标 Thinkorswim is showing lower highs, this could be a sign that the trend is losing momentum and may soon reverse. Divergence can help traders identify potential trend changes before they happen.

KDJ Indicator Strategies for Trading

Now that you understand the basic functionality of the KDJ Indicator, it’s important to explore different strategies that can help you use it effectively in trading. Here are a few strategies to consider:

1. KDJ Crossover Strategy

This is the most straightforward approach. When the K line crosses above the D line, you enter a buy position. When the K line crosses below the D line, you enter a sell or short position. This strategy is most effective in trending markets, as the KDJ signals tend to align with the prevailing trend.

2. Overbought and Oversold Reversal Strategy

When the J line moves above 100, or below 0, it often indicates overbought or oversold conditions. A reversal strategy can be employed by taking trades in the opposite direction once these extreme conditions are met. This strategy is best suited for range-bound markets, where the asset oscillates between overbought and oversold conditions.

3. Divergence Trading Strategy

Traders look for divergence between the price and the KDJ indicator as a sign that the trend is losing strength. For example, if the price is making higher highs, but the KDJ indicator is showing lower highs, it may signal that the upward momentum is weakening. This divergence can indicate a potential reversal, providing an opportunity for a trade.

Common Mistakes to Avoid When Using the KDJ Indicator

Like any trading tool, the KDJ Indicator is not foolproof, and there are common pitfalls that traders should be aware of:

1. Relying Solely on the KDJ Indicator

While the KDJ Indicator is a powerful tool, it should not be used in isolation. Traders should always consider other indicators, such as Moving Averages, RSI, or MACD, to confirm signals and avoid false breakouts or reversals.

2. Ignoring Market Conditions

The KDJ 指标 Thinkorswim Indicator works best in trending markets, but it may give false signals during periods of market consolidation or range-bound conditions. Always take the overall market environment into account before acting on KDJ signals.

3. Not Adjusting Settings for Different Assets

The default settings for the KDJ 指标 Thinkorswim Indicator might not work well for all assets. Be sure to adjust the period lengths based on the asset you’re trading and the timeframe you’re using. For instance, short-term traders may prefer a smaller KDJ 指标 Thinkorswim period, while long-term traders may use a larger setting.

Conclusion

The kdj 指标 Thinkorswim is a versatile and valuable tool for traders looking to better understand market momentum and price trends. By combining elements of the Stochastic Oscillator, RSI, and MACD, the KDJ Indicator provides a more refined approach to identifying overbought and oversold conditions, trend reversals, and potential entry and exit points.

Whether you’re a novice trader or an experienced professional, using the KDJ 指标 Thinkorswim effectively can give you a competitive edge in the markets. By understanding how to set it up on kdj 指标 Thinkorswim, interpreting its signals, and applying it to a solid trading strategy, you can increase your chances of success in your trading endeavors.