In the dynamic world of real estate, understanding the true value of a property is crucial. This is where the role of a Brevard appraiser comes into play. A Brevard appraiser is a professional who evaluates properties in Brevard County to determine their market value. This guide delves into the various aspects of property appraisal, highlighting the importance of accurate appraisals for homeowners, buyers, and financial institutions.

Importance of Property Appraisal

Brevard Appraiser are essential for several reasons. They provide a basis for mortgage loans, help in setting the sale price, and are necessary for tax assessments and legal disputes. An accurate appraisal ensures that buyers do not overpay for a property and sellers receive a fair price. For lenders, it minimizes the risk of loan defaults by ensuring the loan amount is in line with the property’s value.

Relevance to Homeowners and Buyers

For homeowners, an appraisal can help in refinancing or obtaining a home equity loan. Buyers rely on appraisals to confirm they are making a sound investment. Understanding the appraisal process and the factors influencing property values can empower individuals in their real estate transactions.

History of Property Appraisal

Origins and Evolution

Property appraisal has a long history, dating back to ancient civilizations where land and property values were assessed for taxation and ownership purposes. Over the centuries, appraisal methods have evolved, incorporating more sophisticated techniques and standards.

Key Milestones in Property Appraisal

Significant milestones include the establishment of the Appraisal Institute in 1932, which set professional standards, and the creation of the Uniform Standards of Professional Appraisal Practice (USPAP) in 1987, providing guidelines for ethical and competent appraisals.

Types of Property Appraisals

Residential Appraisals

Residential appraisals focus on single-family homes, condominiums, and multi-family residences. These appraisals consider factors like location, size, condition, and comparable sales in the area.

Commercial Appraisals

Commercial appraisals assess properties used for business purposes, such as office buildings, retail spaces, and warehouses. These appraisals often involve a more complex analysis of income potential and market conditions.

Land Appraisals

Land appraisals determine the value of vacant land. Factors such as zoning, location, and development potential are crucial in these assessments.

Industrial Appraisals

Industrial appraisals cover properties used for manufacturing, distribution, and storage. These appraisals require an understanding of the industrial sector and specific property features.

Role of a Brevard Appraiser

Responsibilities

A Brevard Appraiser primary responsibility is to provide an unbiased estimate of a property’s market value. This involves inspecting the property, researching market data, and preparing a detailed appraisal report.

Qualifications and Certifications

To become a certified Brevard Appraiser in Brevard, one must meet state licensing requirements, which typically include education, experience, and passing a comprehensive exam. Continuing education is also necessary to maintain certification.

Day-to-Day Activities

An Brevard Appraiser’s daily activities include conducting site visits, taking measurements, photographing properties, analyzing market trends, and preparing reports. They often interact with real estate agents, lenders, and clients.

Process of Property Appraisal

Initial Consultation

The appraisal process begins with an initial consultation where the Brevard Appraiser gathers basic information about the property and its intended use. This step sets the foundation for the subsequent inspection and analysis.

Site Visit and Inspection

During the site visit, the Brevard Appraiser conducts a thorough inspection of the property. This includes measuring the property, assessing its condition, and noting any unique features. The appraiser also evaluates the surrounding neighborhood and comparable properties.

Data Collection and Analysis

After the site visit, the Brevard Appraiser collects and analyzes data on comparable sales, market trends, and other relevant factors. This information is used to determine the property’s fair market value.

Final Report Preparation

The final step is preparing a detailed appraisal report. This document includes the Brevard Appraiser’s findings, an analysis of comparable sales, and a final estimate of the property’s value. The report is provided to the client and, if applicable, the lender.

Factors Influencing Property Value

Location

Location is one of the most critical factors in property valuation. Proximity to amenities, schools, public transportation, and employment centers can significantly impact a property’s value.

Market Conditions

Current market conditions, such as supply and demand, interest rates, and economic trends, also play a crucial role in determining property value.

Property Condition

The condition of the property, including its age, maintenance, and any recent renovations, affects its value. Well-maintained properties typically appraise higher than those in poor condition.

Comparable Sales

Comparable sales, or “comps,” are recent sales of similar properties in the area. Brevard Appraiser use comps to gauge the market value of the property being appraised.

Common Appraisal Methods

Sales Comparison Approach

The sales comparison approach is the most common method for residential appraisals. It involves comparing the subject property to similar properties that have recently sold in the same area.

Cost Approach

The cost approach estimates the property’s value by calculating the cost to replace the structure with a similar one, accounting for depreciation, and adding the land value. This method is often used for new or unique properties.

Income Approach

The income approach is primarily used for commercial properties. It estimates value based on the property’s ability to generate income, considering factors like rental income, operating expenses, and capitalization rates.

Importance of Accurate Appraisals

For Buyers and Sellers

Accurate appraisals ensure that buyers pay a fair price and sellers receive a fair value for their property. They also help in negotiating prices and making informed decisions.

For Lenders and Financial Institutions

Lenders rely on appraisals to determine the loan amount they can offer. An accurate appraisal reduces the risk of lending more than the property’s worth, protecting the lender’s investment.

For Legal and Tax Purposes

Appraisals are often required for legal matters, such as divorce settlements, estate planning, and tax assessments. Accurate appraisals ensure fair and equitable outcomes in these situations.

Challenges in Property Appraisal

Market Volatility

Real estate markets can be volatile, with rapid changes in property values. Brevard Appraiser must stay informed about market trends to provide accurate valuations.

Unique Properties

Unique properties, such as historic homes or custom-built houses, can be challenging to appraise due to a lack of comparable sales.

Data Availability

Access to accurate and up-to-date data is essential for appraisals. In some areas, limited data availability can pose a challenge for Brevard Appraiser.

Technology in Property Appraisal

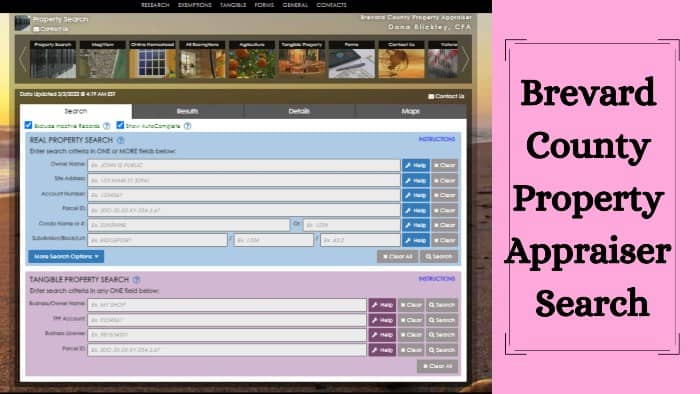

Use of Software and Tools

Modern Brevard Appraiser use advanced software and tools for data analysis, report preparation, and market research. These technologies streamline the appraisal process and improve accuracy.

Impact of Drones and AI

Drones are increasingly used for property inspections, providing aerial views and detailed images. Artificial intelligence (AI) assists in analyzing market trends and predicting property values.

Online Databases and Resources

Online databases offer Brevard Appraiser access to vast amounts of property data, including sales records, tax assessments, and market trends. These resources enhance the accuracy and efficiency of appraisals.

Case Studies: Successful Appraisals in Brevard

Residential Case Study

A detailed examination of a residential appraisal in Brevard, highlighting the process, challenges, and outcomes. This case study illustrates the importance of thorough inspections and accurate data analysis.

Commercial Case Study

An analysis of a commercial property appraisal in Brevard, showcasing the complexities involved in evaluating income potential and market conditions. This case study demonstrates the expertise required for commercial appraisals.

Expert Insights

Quotes from Experienced Appraisers

Insights from seasoned Brevard Appraiser in Brevard, offering their perspectives on the appraisal process, common challenges, and best practices.

Advice for Aspiring Appraisers

Tips and guidance for individuals interested in pursuing a career in property appraisal, including educational requirements and professional development.

Legal and Regulatory Considerations

Local Regulations

An overview of local regulations governing property appraisals in Brevard, including licensing requirements and ethical standards.

National Standards

A discussion of national appraisal standards, such as the USPAP, and their impact on the appraisal profession.

How to Choose a Brevard Appraiser

Credentials to Look For

Key qualifications and certifications to consider when selecting a Brevard appraiser, ensuring they meet professional standards.

Questions to Ask

Important questions to ask potential Brevard Appraiser, such as their experience, methodology, and fees.

Red Flags to Avoid

Warning signs that may indicate an inexperienced or unqualified Brevard Appraiser, helping you make an informed choice.

FAQs about Property Appraisal

Common Questions and Answers

A compilation of frequently asked questions about property appraisals, providing clear and concise answers to help readers understand the process.

Conclusion

Summary of Key Points

A recap of the main topics covered in the article, emphasizing the importance of accurate property appraisals.

Importance of Professional Appraisals

Reiterating the value of professional appraisals for buyers, sellers, lenders, and legal purposes.

Call to Action for Further Information

Encouraging readers to seek further information and professional assistance for their property appraisal needs.