Have you ever wondered how a single strategic decision in property can transform your financial future? In the bustling world of property markets, where opportunities flicker like city lights at dusk, Pedrovazpaulo real estate investment emerges as a beacon for savvy investors. This approach isn’t just about buying and selling; it’s a comprehensive philosophy that weaves together data-driven decisions, ethical practices, and community-focused growth. Drawing from years of expertise, Pedrovazpaulo real estate investment has helped countless individuals navigate the complexities of real estate to build lasting wealth.

In this in-depth exploration, we’ll dive into the essence of Pedrovazpaulo real estate investment, uncovering its principles, strategies, and real-world applications. Whether you’re a novice dipping your toes into property ventures or a seasoned player seeking refined tactics, understanding Pedrovazpaulo real estate investment can unlock new pathways to success. Let’s embark on this journey, starting from the foundations and scaling up to advanced insights.

Who is Pedro Vaz Paulo?

At the heart of Pedrovazpaulo real estate investment lies the visionary mind of Pedro Vaz Paulo, a seasoned consultant whose career spans decades in the financial and property sectors. Born in Portugal, Pedro’s early exposure to European markets sparked his passion for strategic investing. He founded his consulting firm in the late 2000s, focusing on real estate as a cornerstone for wealth creation. What sets Pedro apart is his blend of analytical prowess and empathetic approach—he views investments not merely as transactions but as opportunities to enhance communities.

Pedro’s background includes stints in corporate finance and business strategy, where he honed skills in market forecasting and portfolio management. His entry into real estate was marked by a commitment to sustainable practices, emphasizing properties that offer both financial returns and social value. Today, Pedrovazpaulo real estate investment embodies his ethos: a methodical system that prioritizes long-term gains over short-term flips.

Through workshops, publications, and client advisories, Pedro has mentored thousands, sharing insights on how Pedrovazpaulo real estate investment can adapt to volatile economies. His philosophy resonates globally, from urban developments in Spain to emerging markets in Europe. For those interested in broader business strategies, explore our insights on business consulting fundamentals.

Key Milestones in Pedro’s Career

- Early Beginnings (2000s): Pedro started as a financial analyst, gaining expertise in risk assessment.

- Firm Launch (2008-2010): Established Pedrovazpaulo Consulting, shifting focus to real estate.

- Global Expansion (2015+): Expanded into international projects, incorporating tech-driven analytics.

- Educational Contributions: Authored guides on Pedrovazpaulo real estate investment, influencing new generations.

This foundation underpins why Pedrovazpaulo real estate investment stands out—it’s rooted in real experience, not just theory.

Core Principles of Pedrovazpaulo Real Estate Investment

Pedrovazpaulo real estate investment is built on a triad of principles: sustainability, diversification, and data-centric decision-making. These aren’t buzzwords; they’re actionable guidelines that ensure resilience in fluctuating markets.

First, sustainability in Pedrovazpaulo real estate investment means selecting properties that contribute positively to environments and societies. This could involve eco-friendly renovations or community-oriented developments, aligning with global trends toward green investing.

Diversification is another pillar. Rather than putting all eggs in one basket, Pedrovazpaulo real estate investment advocates spreading across residential, commercial, and even international assets. This mitigates risks from local downturns.

Lastly, data drives everything. Pedro emphasizes thorough research, using tools like market analytics to predict trends. In Pedrovazpaulo real estate investment, every move is backed by evidence, reducing guesswork.

For deeper dives into financial principles, check out our section on finance strategies.

Why These Principles Matter

- Long-Term Wealth: Sustainability ensures enduring value.

- Risk Reduction: Diversification protects against volatility.

- Informed Choices: Data leads to higher success rates in Pedrovazpaulo real estate investment.

By adhering to these, investors can mirror Pedro’s successes.

Strategies for Success in Pedrovazpaulo Real Estate Investment

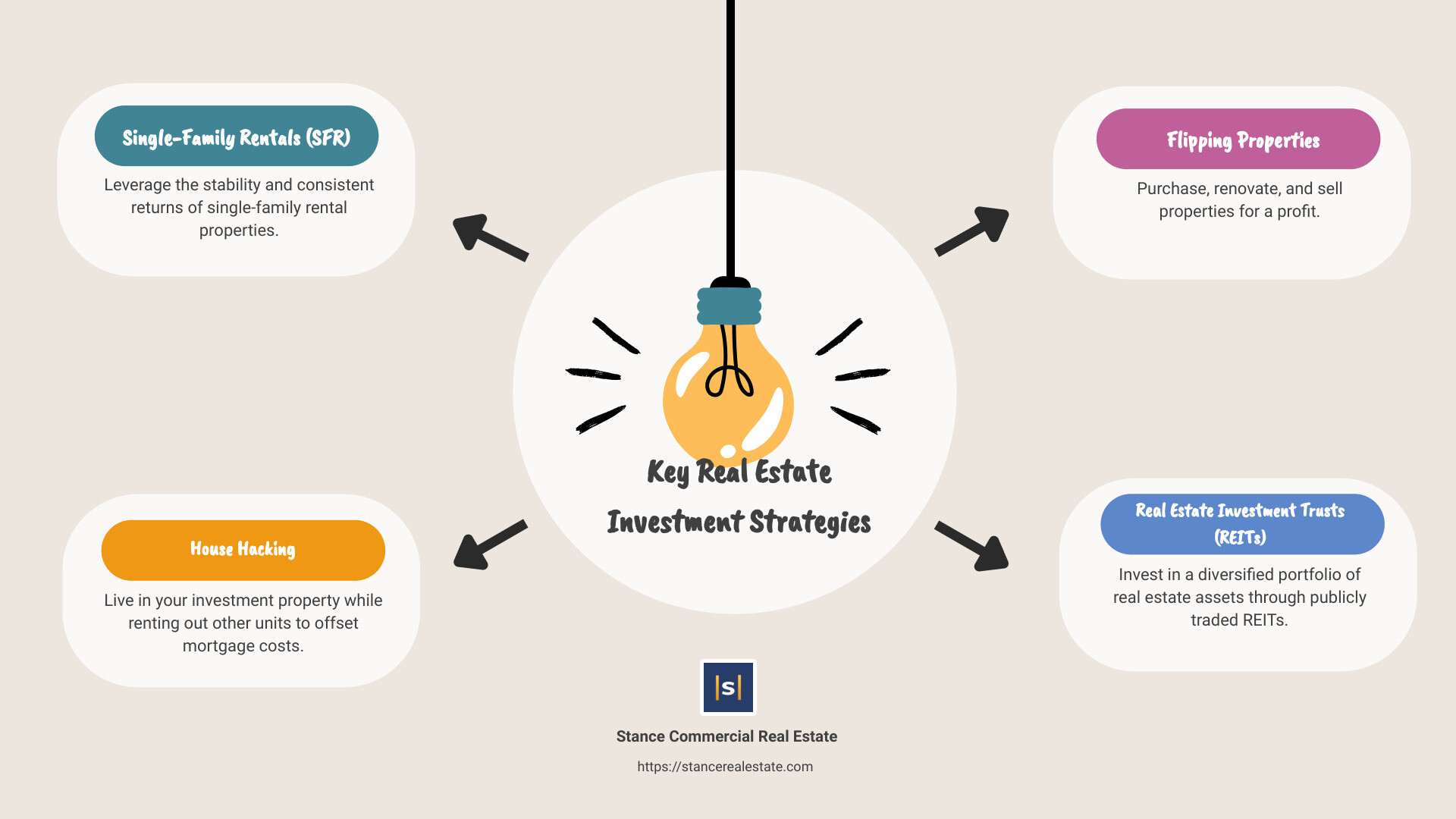

Diving deeper, Pedrovazpaulo real estate investment offers a toolkit of strategies tailored for various investor profiles. These aren’t one-size-fits-all; they’re adaptable, allowing customization based on goals and resources.

Buy and Hold Strategy

One cornerstone of Pedrovazpaulo real estate investment is the buy and hold approach. This involves acquiring properties with strong rental potential and holding them for appreciation. Pedro advises focusing on areas with growing populations, where demand outpaces supply. Over time, rental income covers costs while equity builds.

Pros:

- Steady cash flow.

- Tax benefits from depreciation.

- Capital gains upon sale.

Cons:

- Requires patience.

- Maintenance ongoing.

In Pedrovazpaulo real estate investment, this strategy shines for passive income seekers.

BRRRR Method

For more active investors, the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) method is a gem in Pedrovazpaulo real estate investment. Start by buying undervalued properties, rehab them to boost value, rent for income, refinance to extract equity, and repeat. Pedro stresses meticulous budgeting during rehab to avoid overages.

Steps:

- Identify distressed assets.

- Renovate strategically.

- Secure tenants.

- Refinance at higher value.

- Reinvest proceeds.

This cycles capital efficiently, amplifying returns in Pedrovazpaulo real estate investment.

Diversification Tactics

Pedrovazpaulo real estate investment heavily promotes diversification. Mix property types: apartments for steady rent, offices for corporate leases, or even vacation homes for seasonal gains. Geographically, spread across regions to hedge against local slumps.

Examples:

- Urban vs. suburban.

- Domestic vs. international.

- Residential vs. commercial.

This balanced portfolio is key to enduring success in Pedrovazpaulo real estate investment.

For tips on property types, visit our real estate category.

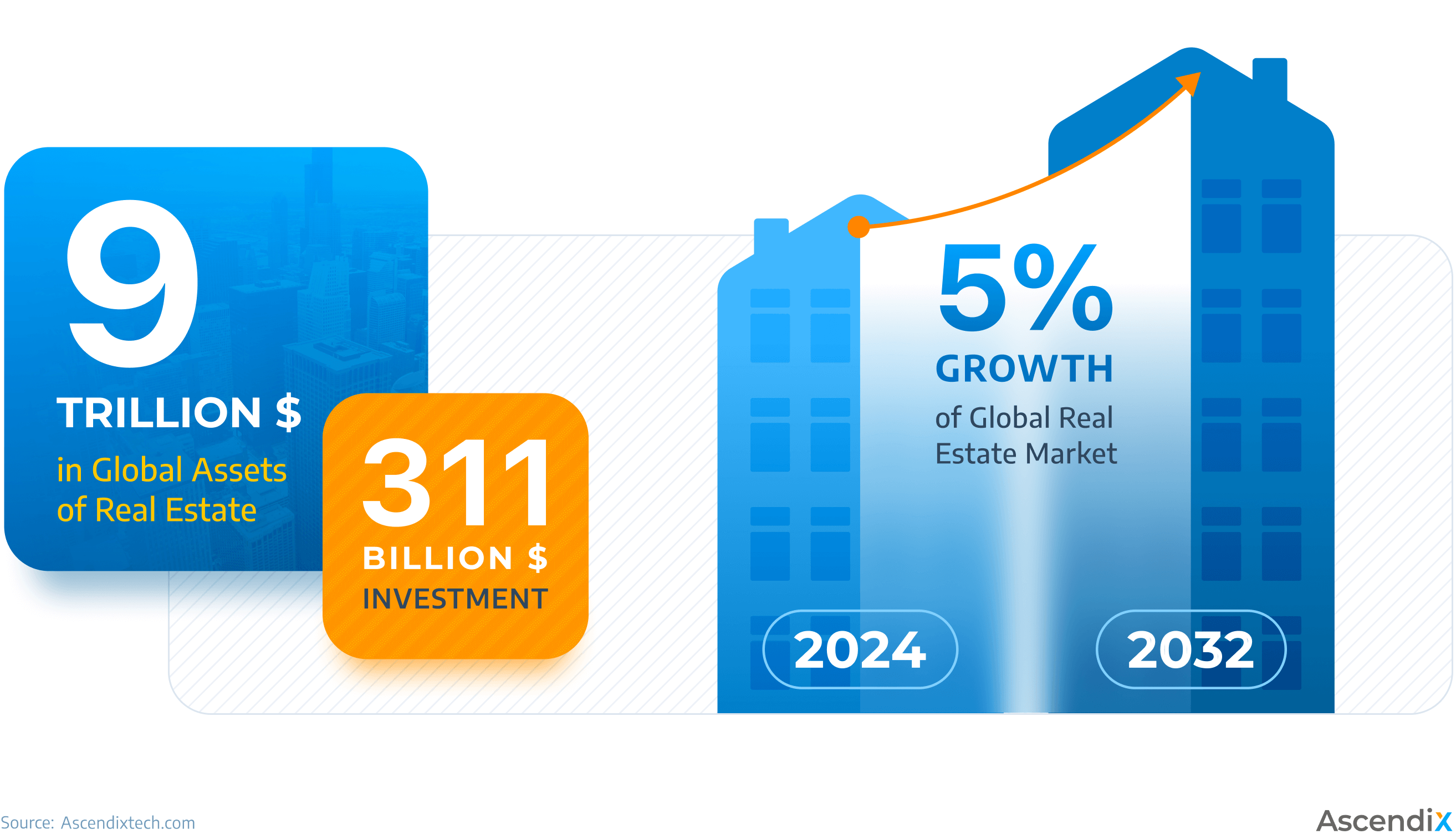

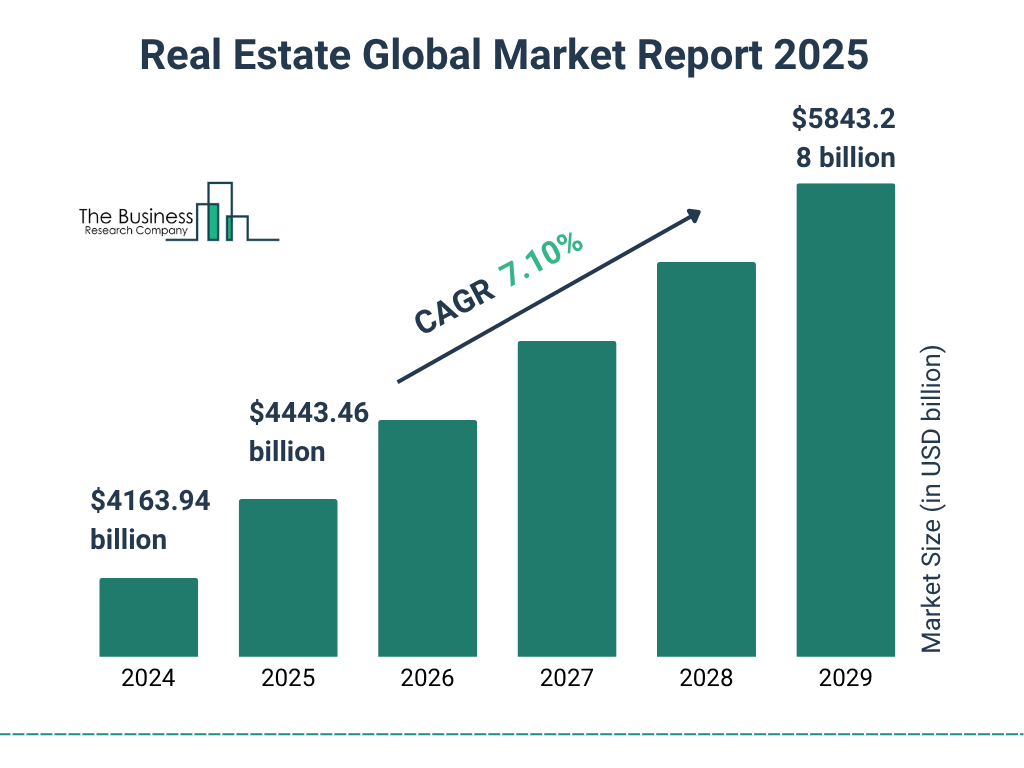

Market Analysis and Research in Pedrovazpaulo Real Estate Investment

No strategy succeeds without solid research, and Pedrovazpaulo real estate investment places market analysis at its core. Pedro teaches investors to scrutinize economic indicators, demographic shifts, and infrastructure developments.

Tools for Effective Analysis

- Economic Data: Track GDP growth, employment rates.

- Demographics: Analyze population age, income levels.

- Tech Integration: Use AI for predictive modeling.

In Pedrovazpaulo real estate investment, staying ahead means monitoring global events, like policy changes or tech booms affecting property values.

Case Example: Urban Revitalization

Consider a city undergoing tech hub transformation. Pedrovazpaulo real estate investment would involve buying early in emerging neighborhoods, anticipating value surges.

Charts and graphs often illustrate these trends, helping visualize opportunities.

Benefits of Thorough Research

- Identifies undervalued gems.

- Avoids overhyped bubbles.

- Enhances decision confidence in Pedrovazpaulo real estate investment.

Investors who master this step often see superior returns.

Risk Management Techniques

Risk is inherent in property ventures, but Pedrovazpaulo real estate investment equips you with tools to manage it effectively. Pedro’s framework includes insurance, legal reviews, and contingency planning.

Common Risks and Mitigations

- Market Fluctuations: Diversify holdings.

- Tenant Issues: Screen rigorously, use contracts.

- Financial Overextension: Secure fixed-rate loans.

In Pedrovazpaulo real estate investment, regular audits ensure portfolios remain robust.

For legal aspects, explore our law resources.

Advanced Risk Strategies

- Stress testing scenarios.

- Building emergency funds.

- Partnering with experts.

These safeguard your Pedrovazpaulo real estate investment journey.

Financing Options Explored

Funding is crucial, and Pedrovazpaulo real estate investment offers creative financing paths beyond traditional mortgages.

Key Options

- Conventional Loans: For stable properties.

- Hard Money Loans: Quick for flips.

- Crowdfunding: Pool resources online.

- Seller Financing: Negotiate terms directly.

Pedro recommends leveraging low-interest periods while maintaining healthy debt ratios.

Illustrations of these options clarify choices.

Tips for Securing Finance

- Build strong credit.

- Prepare detailed plans.

- Network with lenders.

In Pedrovazpaulo real estate investment, smart financing accelerates growth.

Case Studies of Pedrovazpaulo Real Estate Investment

Real-world examples bring Pedrovazpaulo real estate investment to life. Let’s examine a few anonymized successes.

Case Study 1: Residential Turnaround

An investor using Pedrovazpaulo real estate investment bought a rundown apartment in a growing suburb. Through BRRRR, they rehabbed, rented, and refinanced, yielding 25% annual returns.

Lessons:

- Spot potential early.

- Budget renovations wisely.

Case Study 2: Commercial Diversification

Shifting to offices during a boom, this Pedrovazpaulo real estate investment approach netted stable leases amid residential dips.

Outcomes:

- Consistent income.

- Portfolio resilience.

These stories showcase the practicality of Pedrovazpaulo real estate investment.

Case Study 3: International Venture

Expanding to European markets, an investor applied Pedrovaz paulo real estate investment principles, blending local insights with diversification for cross-border gains.

Future Trends Shaping Pedrovaz paulo Real Estate Investment

Looking ahead, Pedrovaz paulo real estate investment evolves with trends like sustainability tech, remote work impacts, and AI analytics.

Emerging Opportunities

- Green Properties: Eco-certifications boost value.

- Virtual Real Estate: Metaverse integrations.

- Urban Migration Reversals: Suburban booms.

Pedro predicts AI will revolutionize analysis in Pedrovaz paulo real estate investment.

For tech trends, see our tech category.

Preparing for Tomorrow

- Adopt new tools.

- Stay educated.

- Adapt strategies.

This forward-thinking keeps Pedrovaz paulo real estate investment relevant.

Conclusion: Embracing Pedrovaz paulo Real Estate Investment

In summary, Pedrovaz paulo real estate investment offers a robust framework for wealth building, blending strategy, research, and ethics. By incorporating these elements, you can navigate real estate with confidence. Start small, learn continuously, and watch your portfolio flourish. Pedrovaz paulo real estate investment isn’t just a method—it’s a mindset for enduring success.