In the digital age of 2025, your credit score is more than just a number—it’s a key that unlocks financial opportunities, from securing a mortgage for your dream home to getting the best rates on a car loan. When questions or concerns about your credit report arise, knowing who to trust is paramount. The number 8009556600 is a critical piece of that puzzle.

This number is the official customer service line for Experian, one of the three major national credit bureaus. This comprehensive guide will demystify everything you need to know about 8009556600: who it’s for, when to call, how to prepare, and how to navigate their services to take control of your financial narrative.

What is 8009556600? Identifying the Number

Simply put, 8009556600 is the primary, publicly-listed customer service telephone number for Experian Information Solutions, Inc. It is not a scam or a fraudulent number. When you see this number on your caller ID, it is almost certainly a legitimate call from Experian.

Calls from this number are typically related to:

-

Credit Monitoring Alerts: Notifying you of significant changes to your credit report, such as a new account being opened, a hard inquiry, or a change in your credit score.

-

Product-Related Inquiries: Follow-ups or discussions regarding your Experian membership, such as CreditWorks℠ or their identity theft protection services.

-

Security and Fraud Prevention: Experian may call to verify suspicious activity or potential fraud attempts linked to your identity.

-

General Customer Service: Addressing billing questions, technical support for online accounts, or other service-related issues.

It’s important to remember that while 8009556600 is legitimate, scammers often “spoof” phone numbers to appear trustworthy. Experian will never call you from this number to ask for sensitive information like your full Social Security number, your credit card number, or your mother’s maiden name to “verify your account.” If you receive a call that feels suspicious, hang up and call back directly using the official number found on their website, Experian.com.

Key Reasons to Contact 8009556600 in 2025

Understanding your credit is an active process. You are not just a passive observer. Picking up the phone and calling 8009556600 can be a powerful step in managing your financial health. Here are the most common and important reasons to reach out.

1. Disputing Errors on Your Credit Report

Mistakes happen. A study in 2023 found that over one-third of consumers found errors on their credit reports. These errors can unfairly lower your score and cost you money.

-

What to Dispute: Incorrect personal information, accounts that don’t belong to you, duplicate accounts, inaccurate account statuses (e.g., showing a late payment you made on time), or fraudulent accounts opened due to identity theft.

-

Why It’s Crucial: Under the Fair Credit Reporting Act (FCRA), credit bureaus are legally obligated to investigate any item you dispute, typically within 30 days. Correcting errors can lead to a significant and immediate boost in your credit score.

2. Placing or Lifting a Security Freeze

A security freeze is one of the most powerful tools available to prevent identity theft. It locks your credit file so that new creditors cannot access it, making it nearly impossible for an identity thief to open new accounts in your name.

-

Placing a Freeze: You can request a freeze over the phone at 8009556600. It is free to place, lift, or remove a freeze by federal law.

-

Lifting a Freeze: When you legitimately need to apply for credit (e.g., for a car loan or new apartment), you can temporarily “thaw” or lift the freeze for a specific period or a specific creditor.

3. Placing an Extended Fraud Alert

If you have been a victim of identity theft, you are entitled to place an extended fraud alert, which lasts for seven years.

-

The Process: When you call 8009556600 to place an extended alert, Experian is required to notify the other two bureaus (Equifax and TransUnion) on your behalf.

-

The Benefit: This alert requires businesses to verify your identity by contacting you directly before issuing new credit in your name. It adds a crucial extra layer of security.

4. Managing Your Paid Experian Membership Services

If you subscribe to a paid service like Experian CreditWorks™ or IdentityWorks™, 800-955-6600 is your go-to for:

-

Billing inquiries and issues.

-

Troubleshooting access to your online account or mobile app.

-

Understanding the features and benefits of your plan.

-

Updating your payment information.

-

Canceling your subscription, if desired.

5. General Inquiries and Support

You might call for other reasons, such as:

-

Requesting a copy of your credit report if you’ve had issues online.

-

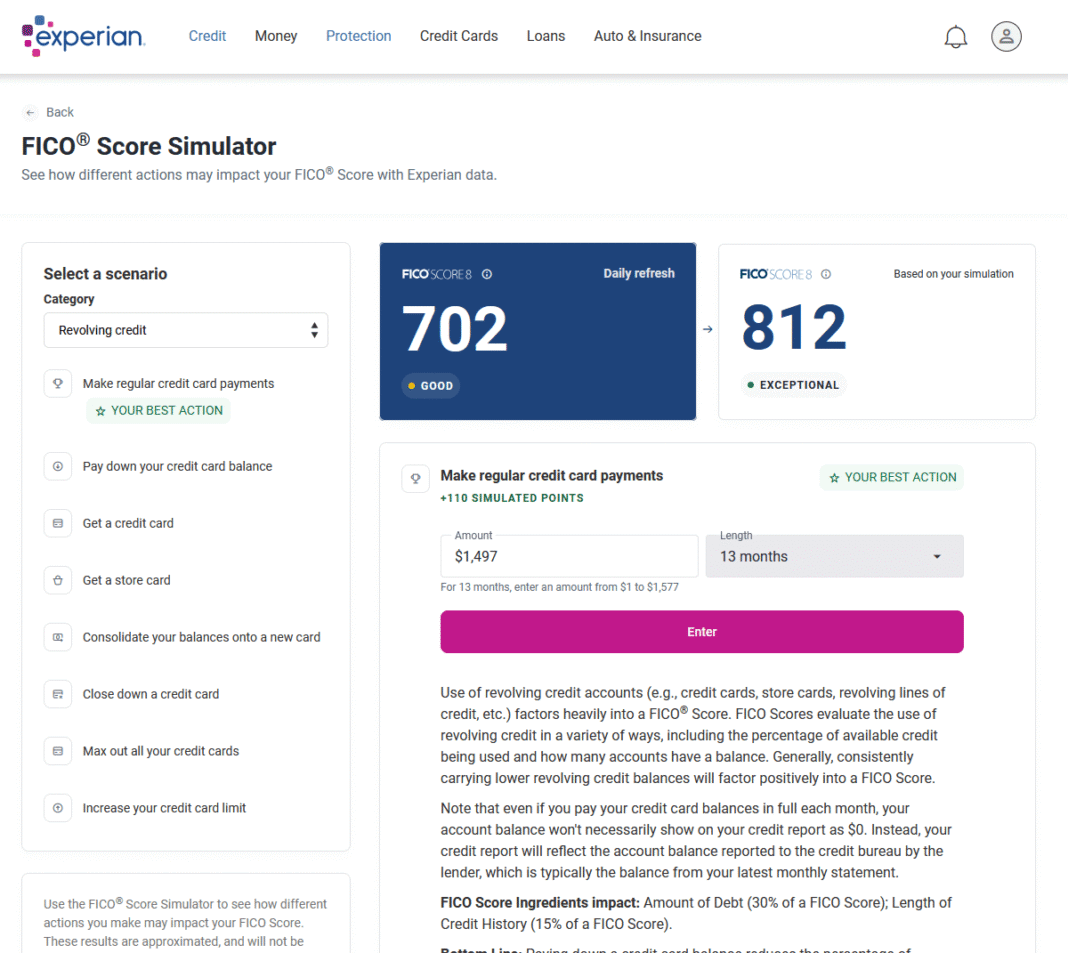

Asking questions about how specific actions affect your credit score.

-

Seeking guidance if you’ve been denied credit based on your Experian report.

How to Prepare Before You Call 8009556600

To ensure your call is efficient and productive, a little preparation goes a long way. Customer service lines can be busy, so being ready will help you resolve your issue in a single call.

Gather These Documents and Information:

-

Personal Information: Your full name, date of birth, and address (current and previous).

-

Social Security Number (SSN): Have this ready for identity verification.

-

A Copy of Your Experian Credit Report: This is essential. You can get a free report annually from AnnualCreditReport.com or weekly as of 2025. If you are a member, have your latest report from Experian.com handy.

-

Details of Your Issue: For disputes, note the specific account name, account number, and the nature of the error. Have any supporting documentation ready, like payment confirmations or police reports (for identity theft).

-

Pen and Paper: To take notes during the call, including the name of the representative, the time/date of the call, and any reference or case number provided.

A Step-by-Step Guide to the Call Process

Knowing what to expect can reduce anxiety and make the process smoother.

-

Dial 800-955-6600: You will be greeted by an automated voice response system.

-

Navigate the Menu: Listen carefully to the options. You will likely be asked to state the reason for your call or press a number for specific services (e.g., “press 2 for disputes”).

-

Identity Verification: This is a critical security step. You will be asked to provide personal information to confirm you are the account holder. This is standard procedure.

-

Connect with a Representative: Once verified, you will be connected to a live agent. Politely and clearly state the reason for your call.

-

Explain Your Situation: Provide the agent with the details you prepared. Be clear, concise, and factual.

-

Follow Instructions: The agent will guide you through the next steps, which may involve filling out specific forms, sending documentation, or explaining the investigation process.

-

Get a Confirmation and Reference Number: Before hanging up, always ask for a confirmation number or case number for your records. This is your proof that the interaction took place and is crucial for follow-ups.

Alternative Methods to Contact Experian

While 8009556600 is a direct line, it’s not the only way to manage your credit file. In 2025, digital options are often faster for certain tasks.

-

Online Dispute Center (Recommended): The most efficient way to dispute an error is often directly through Experian’s online dispute portal at www.experian.com/disputes. This allows you to submit your dispute 24/7 and track its status online.

-

U.S. Mail: You can mail a dispute letter along with copies of supporting documents to:

Experian

P.O. Box 4500

Allen, TX 75013

Always send letters via certified mail with a return receipt requested. -

Experian Website and Mobile App: For members, most account management, credit monitoring, and score simulation can be handled seamlessly through Experian’s digital platforms.

Protecting Yourself: Important Security Warnings

Your vigilance is your first line of defense.

-

Experian Will Not Ask For: Your full SSN, credit card number, or bank account information over the phone to “verify” an account. They already have this information on file.

-

Beware of Phishing Scams: Do not respond to emails or text messages that ask you to call a number other than the official 8009556600. Scammers create fake numbers and websites that look incredibly real.

-

Initiate the Call Yourself: If you are unsure about a call you received, hang up. Then, independently look up Experian’s contact information on their official website (Experian.com) and call 8009556600 yourself. This ensures you are connected to the real Experian.

Conclusion: Empowering Your Financial Journey

The number 8009556600 is more than just a sequence of digits; it is a direct gateway to understanding and managing a fundamental aspect of your financial life. In 2025, being proactive about your credit is non-negotiable. Whether you are disputing an error, locking your credit from thieves, or simply asking a question, knowing how to use this number effectively empowers you to take control.

Your credit report is your financial story. Make sure it’s told accurately. By using 800-955-6600 wisely and preparedly, you ensure that you are the author of that story.